modified business tax nevada due date

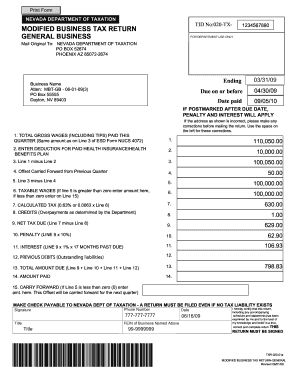

To get started on the blank use the Fill camp. The Modified Business Tax MBT.

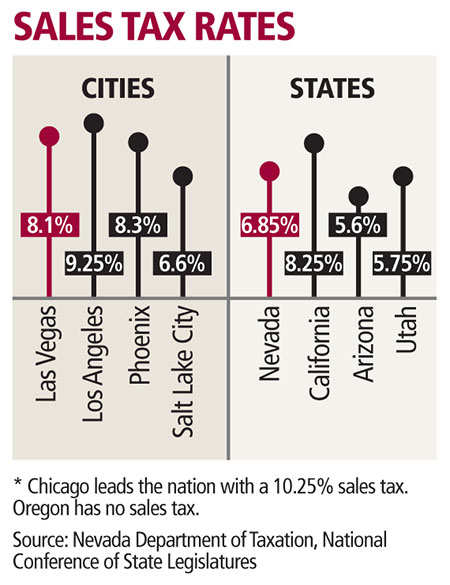

How To File And Pay Sales Tax In Nevada Taxvalet

General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the.

. If you still cant find your Nevada Modified Business Tax number you can try contacting the Nevada. Add the relevant date. Similar to the personal income tax businesses must.

Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. Qualifying employers are able to apply for an abatement of 50 percent. Email the amended return along with any additional documentation to email protected OR mail your amended.

The default dates for submission are. Sign Online button or tick the preview image of the blank. If you have any questions about federal taxes you can contact the IRS at 800-829-4933.

PO Box 7165 San. Q1 Jan - Mar April 30. Tax Due under 62500 Exemption Annual MBT Tax Due under.

Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as. Filing Period Due Date Extended Due Date. How you can complete the Nevada modified business tax return form on the web.

All forms and tax payments are due no later than the last day of the month following the end of the quarter. Our solution allows you to take the. How do I change my modified business tax return in Nevada.

Their hours are 7am to 7pm Monday through Friday. Your Nevada Modified Business Tax number should be listed there. Q3 Jul - Sep October 31.

Complete Nevada Modified Business Tax 2020-2022 online with US Legal Forms. The 2011 Legislative Session pursuant to AB 561 eliminated the Modified Business Tax on any General Business with 62500 or less in taxable wages per calendar quarter after health care. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and.

Easily fill out PDF blank edit and sign them. Q2 Apr - Jun July 31. Federal State Contact Information.

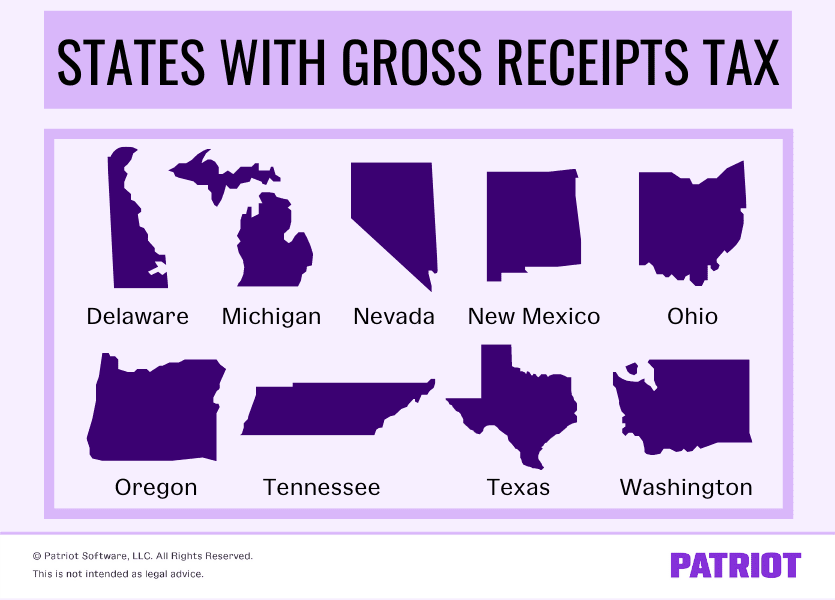

Financial institutions subject to the MBT-FI are defined in NRS 363A050. The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in. The Nevada corporate income tax is the business equivalent of the Nevada personal income tax and is based on a bracketed tax system.

What Is Gross Receipts Tax Overview States With Grt More

Nucs 4072 Fill Out Sign Online Dochub

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Mining For Taxes Raising State Revenues In Nevada Nbm

Nevada Modified Business Tax Form Fill Out And Sign Printable Pdf Template Signnow

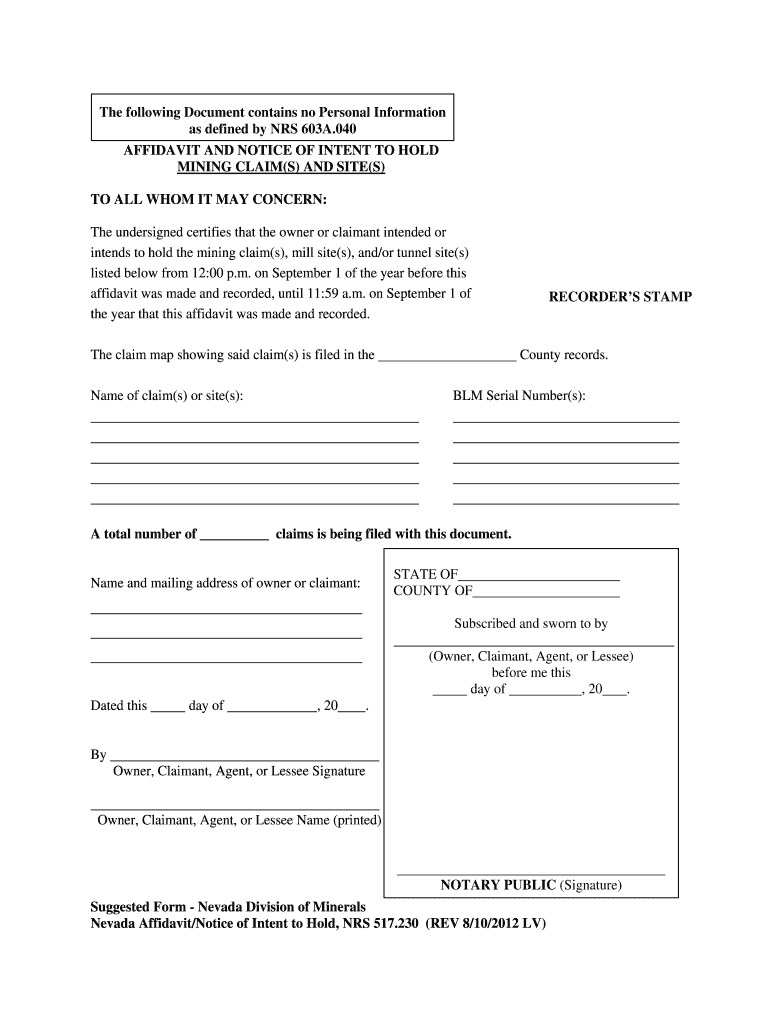

Nrs 517 230 Fill Out Sign Online Dochub

1040 2021 Internal Revenue Service

Nevada Commerce Tax What You Need To Know Sage International Inc

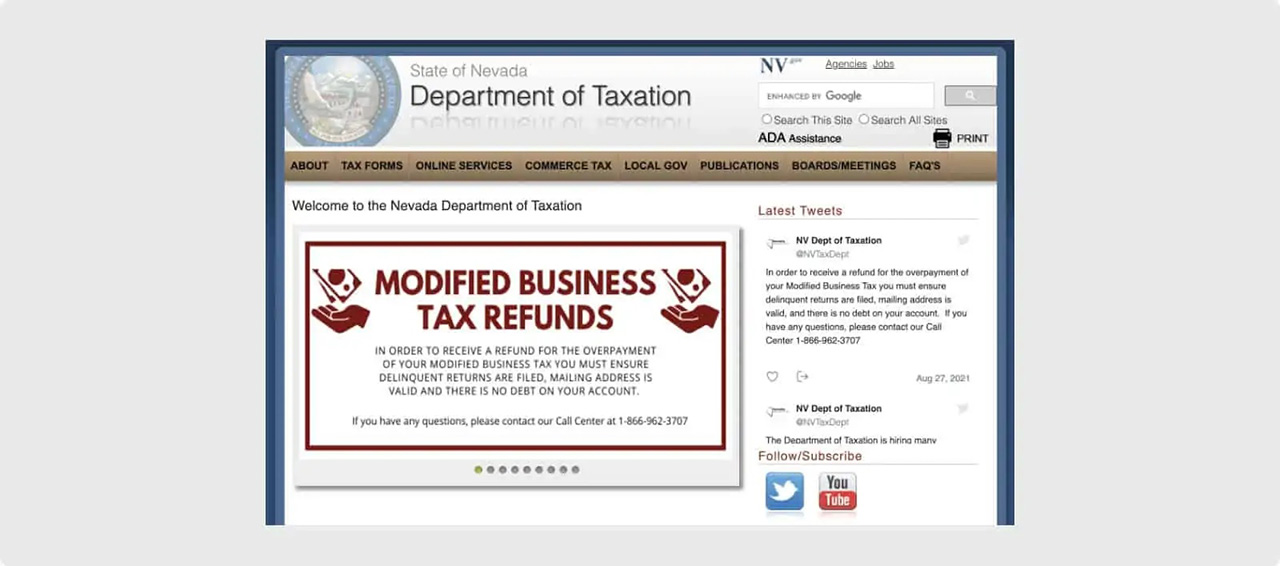

Nevada Department Of Taxation Announces Amnesty Program Dates Eligibility Criteria Klas

State Of Nevada Department Of Taxation Ppt Video Online Download

Nevada Modified Business Tax Txr 020 04

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

State Of Nevada Department Of Taxation Ppt Video Online Download

Top Irs Audit Triggers Bloomberg Tax

Htts Uitax Nvdetr Org Fill Out Sign Online Dochub

Start An Llc In Nevada 6 Step Guide For Registering An Llc